arizona solar tax credit form

The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022. The Arizona tax credit for solar panels is 25 of your systems installed costs.

A Basic Arduino Nano Based Portable Device Having Portable Power A Basic Display And Circuitry To Measure Volta Arduino Projects Diy Arduino Projects Arduino

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

. We will update this page with a new version of the form for 2023 as soon as it is made available by the Arizona government. Energy Equipment Property Tax Exemption. On this form on line 1.

Their tax credit incentive will let you deduct 25 of the cost of your solar energy system from your state income taxes. The 25 state solar tax credit is available for purchased home solar systems in Arizona. 1 Best answer.

Arizona Department of Revenue. What do I need in order to claim the tax credit. IMPORTANT which you computed your credits with your individual income tax return.

Arizona tax credit forms and instructions for all recent years can be obtained at. Therefore you arent required to pay any. Phoenix AZ Homeowners who installed a solar energy device in their residential home during 2021 are advised to submit Form 310 Credit for Solar Energy Devices with their individual income tax return and Form 301 Nonrefundable Individual Tax Credits and Recapture.

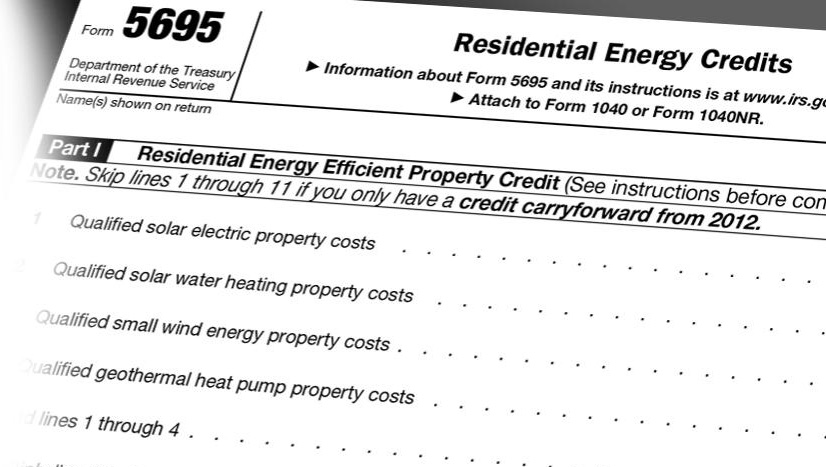

However unlike the federal governments tax credit incentive Arizona tax credits have a limit. However there is also a specific Arizona solar tax credit that can be combined with the nationwide benefit and it gets deducted from your state income taxes. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells.

This incentive comes right off of your income tax for the same year you install the solar system. Arizona Department of Revenue tax credit. Youll need your receipt for purchase and installation a manufacturers certification and IRS Form 5695.

Include with your return. Worth 26 of the gross system cost through 2020. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed 25000 in credits for one building in a single tax year and 50000 total credits per business per tax year.

1000 personal income tax reduction 6. Install one or more solar energy devices in their Arizona facilities. The tax credit amount was 30 percent up to January 1 2020.

The state sales tax of 56 does not apply to solar equipment. The Renewable Energy Production Tax Credit is applied for using Arizona Form 343. Arizona Residential Solar Energy Tax Credit.

Equipment and property tax exemptions. 101 1 You must include Form 301 and the corresponding credit forms for. Arizona just like the federal government is offering an income tax credit for switching to a solar energy system.

For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y. Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden of any Arizona solar tax. Residential Arizona Solar Tax Credit.

This form is for income earned in tax year 2021 with tax returns due in April 2022. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. A solar energy device is a system or series of mechanisms which collect and transfer solar.

The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. Here are the specifics. Enter your energy efficiency property costs.

12 rows Renewable Energy Production Tax Credit. June 6 2019 1029 AM. Arizona solar tax credit.

More about the Arizona Form 310 Tax Credit. Arizona Form 344 Solar Liquid Fuel Credit - 2021 Arizona TaxFormFinder. Well use 25000 gross cost of a solar energy system as an example.

To claim this credit you must also complete Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture and include both forms with your tax return. No preapproval is required for an individual income tax credit for a residential Solar Energy Device tax credit that is claimed on Form 310. Renewable Energy Production Tax Credit Program Office of Economic Research Analysis Arizona Department of Revenue PO.

Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. We last updated Arizona Form 310 in March 2022 from the Arizona Department of Revenue. Arizona Form 2021 Credit for Solar Energy Devices 310 Include with your return.

This is a one time tax credit and restricts the homeowner for additional credits for solar purchases made for the same residence in subsequent yearsThe law establishing the tax credit imposed several requirement. Qualified solar electric property costs youll enter the cost of the product and installation. Form 301 and its instructions for all relevant tax years can be found at.

Your Name as shown on Form 140 140PY 140NR or 140X Your Social Security. The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022. Credit For Solar Energy Credit.

Any unused credit amounts may be carried forward for a five. For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y. The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies Wind Fuel Cells Geothermal and Heat Pumps.

The 26 federal tax credit is equivalent to 3393. Tax credits may be used to offset Arizona income tax liability. The 30 tax credit applies as long as the home solar system is installed by December 31 2019.

Arizona Income Tax Forms. Do solar products in my second home or rental property qualify. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000.

Thats a nice bonus to add to the 26 federal solar tax credit which has no incentive cap and can be claimed over multiple years if necessary. This is a personal solar tax credit that reimburses you 5 of the cost of your solar panels up to 10001000 maximum credit per residence irrespective of the number of energy devices installed. Homeowners can claim a 25 tax credit on up to 4000 of solar devices installed on a residence effectively a maximum credit of 1000.

Summary of solar rebates in Arizona. You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income.

In addition to Arizonas solar incentives youll be eligible for the federal solar tax credit if you buy your own home solar system outright. 25 of the gross system cost up to a maximum of 1000. Add the 1000 Arizona tax credit and you get a total deduction of 4393.

Georgia Firearm Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsof Bill Of Sale Template Templates Make Business Cards

Solar Tax Credit In 2021 Southface Solar Electric Az

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Tips For Finding Big Savings Around The House Living On A Budget Piggy Bank Budget Saving Living On A Budget

Typical Window U Values Workshop Insert Image R Value

Prophecy Stone From Egypt Strengthen Your Instinct Etsy Prophecy Orgonite Stone

Build Your Own Windmill How To Make A Windmill To Generate Electricity Solar Energy Diy Windmill Solar Power Diy

Nanoday Nanotechnology Used In The Storage Of Solar Energy Solar Energy Facts Solar Energy System Solar Energy Diy

Cash For Your Car In Idaho Free Same Day Pickup Free Printable Certificate Templates Money Template Templates Printable Free

Solar Tax Credit Details H R Block

Solar Energy With Sunset Glow Solar Energy Panels Solar Solar Installation

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Salmonella Poses A Triple Threat Ranging From Food Poisoning To Lethal Infection Salmonella Food Poisoning Africa

Back To Back Sun Storms May Supercharge Earth S Northern Lights Space And Astronomy Earth And Space Science Astronomy

Schools Are Saving With Solar On Day One With Our Solar Leasing Program Residential Solar Solar Panels Solar Energy Companies

Everything You Need To Know About The Solar Tax Credit Palmetto